Ellora's Cave: An Interesting USDOT Finding

12 September 2015

This was an interesting Google find that you can locate by searching on: USDOT Ellora’s Cave and clicking on the fmcsa.dot.gov link on the first page.

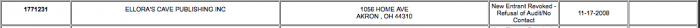

The “OOS” (Out of Service) category column has an entry which states: New Entrant Revoked – Refusal of Audit/No Contact and the “OOS Date” (Out of Service Date) is November 17, 2008.

Per the MSCIP Step Chart, which explains the various possible explanations that appear in the “OOS” category column. While there is no perfect match, this appears to most closely match the description for Step #63.

But what does it mean?

I believe it may be about the Ellora’s Cave bus.

Per the USDOT website: > Apart from federal regulations, some states require commercial motor vehicle registrants to obtain a USDOT Number. These states include:

[…]

• Ohio

Per that, it appears that any commercial registration in Ohio requires a valid USDOT number.

Note that this isn’t a USDOT number for the vehicle, but rather for the carrier. So if Ellora’s Cave had, oh, any commercial vehicle registered to the company, they’d need to have a current, valid USDOT number with no Out of Service Orders.

Like, say, if they owned a bus.

It does seem odd, given that the description for Step 63 says that yes, the carrier’s vehicles would be targeted at roadside, and yes, deny registration, that this situation appears to be unaddressed after almost seven years.

There’s a formal process for issuing an out of service order, detailed here. It just strikes me that it’d be the kind of thing that’d be hard to miss.

It’s not unheard of for government sites to be incorrect, though, so I don’t want to read too much into it.